Sam Bankman-Fried wants only six years for his "victimless" crime

Sam Bankman-Fried maintains that his crimes were victimless and resulted in zero losses, and therefore warrant only six years of imprisonment. Prosecutors argue that 40–50 years are justified.

Sam Bankman-Fried and federal prosecutors have both filed their sentencing memorandums ahead of Bankman-Fried's sentencing, which is scheduled for Thursday, March 28.

While the pre-sentence report prepared by the Probation Department calculates Bankman-Fried's sentence based on sentencing guidelines at 100 years, the government has requested a 40 to 50 year sentence. They say this would be sufficient to prevent him from reoffending and would provide the desired deterrent effect for other would-be offenders, while still providing Bankman-Fried the opportunity to get out of jail within his lifetime. Bankman-Fried, on the other hand, says 5¼ to 6½ years seems fair to him.a

Each sentencing memo describes the same series of events that led to Bankman-Fried's conviction on seven felony charges, but the two stories could not be more different.

To hear Bankman-Fried tell it, FTX was a "fantastically successful" and profitable business run by a "brilliant" "genius" who founded out of his desire to "earn to give". As for its downfall, well:

Alameda’s failure to hedge its positions, the market crash, and a massive customer “run” on FTX led to a liquidity crisis in November 2022. Even amidst that crisis, Sam was resolute: Alameda and FTX each and together remained solvent, and assets were available for all customers to be paid in full. Sam’s hopes of facilitating that goal were stymied when the companies were placed in an omnibus Delaware bankruptcy. – Sentencing Submission

Nevertheless, Bankman-Fried maintains that there were no losses and, therefore, no victims: "The harm to customers, lenders, and investors is zero."

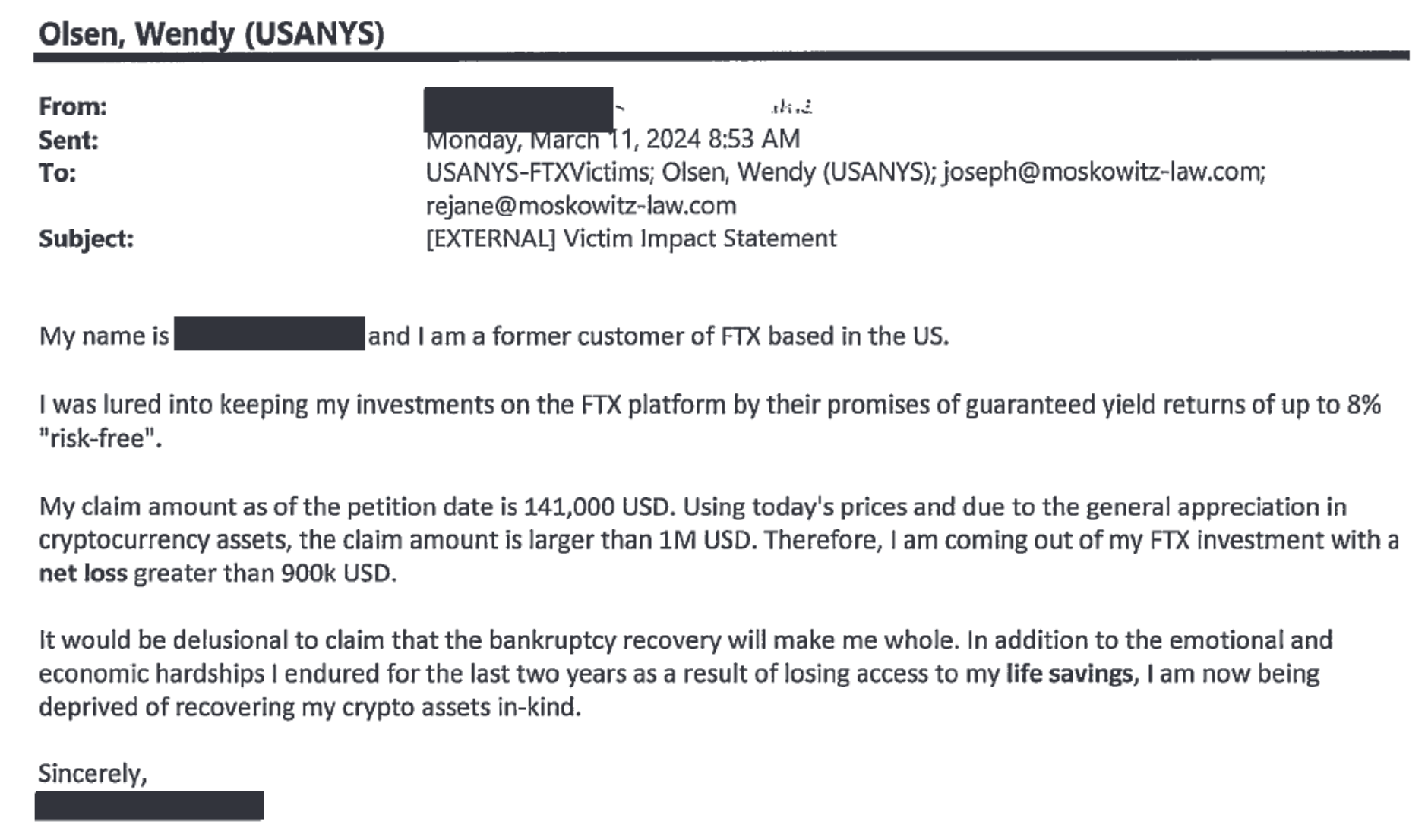

This claim has clearly angered the many victims who have submitted impact statements, which were attached by the government along with their sentencing submission, and which describe ruined lives and countless instances of people who have suffered enormous financial and mental distress.

In their sentencing submission, prosecutors describe multiple instances throughout FTX's operation in which Bankman-Fried could have ended the fraud, but instead opted to double down. They describe the oft-repeated figure of $8 billion in losses as a conservative lower bound.

All of this conduct was willful. In every part of his business, and with respect to each crime committed, the defendant demonstrated a brazen disrespect for the rule of law. He understood the rules, but decided they did not apply to him. He knew what society deemed illegal and unethical, but disregarded that based on a pernicious megalomania guided by the defendant’s own values and sense of superiority. And he knew his customers’ expectations—that he would hold their money safe—but he disregarded them based on a callous belief that he could put their money to better use. – Sentencing Submission

Bankman-Fried, they say, led a life of "unmatched greed and hubris".

The loss

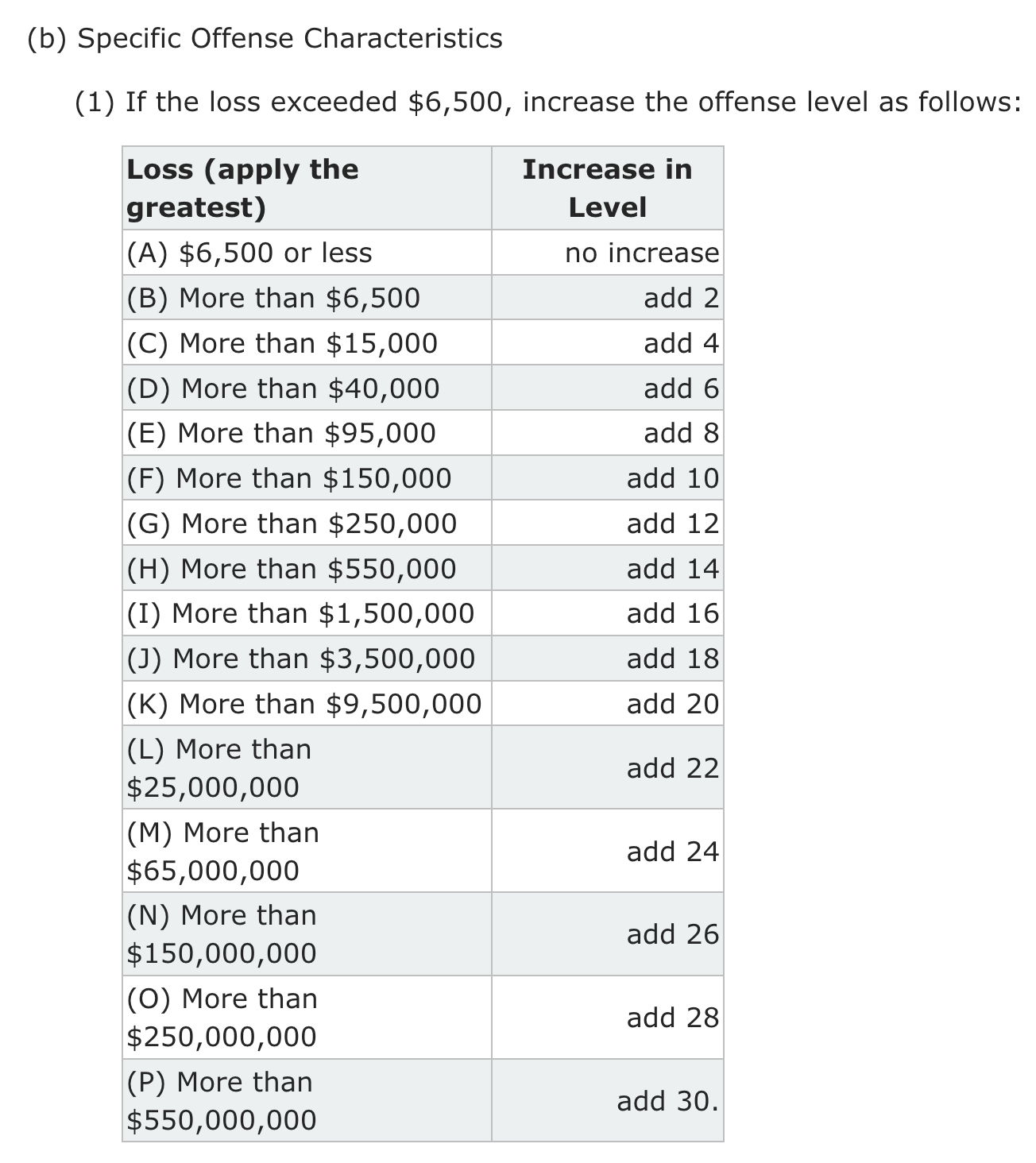

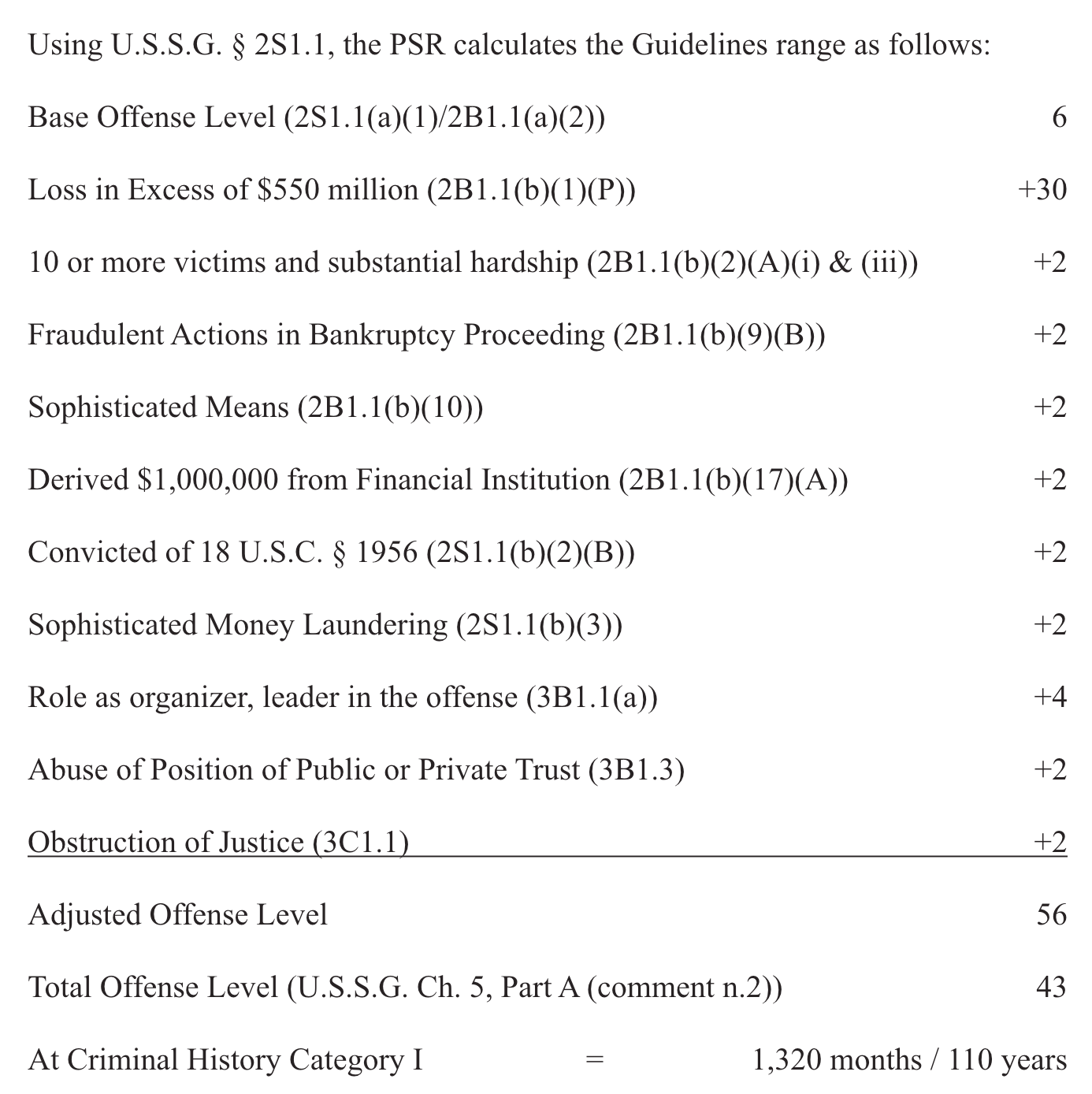

Prosecutors claim that the FTX fraud resulted in a more than $10 billion loss, based on more than $8 billion lost by customers, more than $1.7 billion lost by FTX investors, and more than $1.3 billion lost by Alameda lenders. Although the precise number isn't clear, there's no question from the government's side that it exceeds $550 million, which is where the sentencing guidelines max out.

Bankman-Fried, however, is trying to argue that no money has been lost thanks to his fraud, mostly based on the argument that the bankruptcy team has estimated that creditors will receive a "100% recovery". In a later letter, he even submits that he tried to help the bankruptcy team recover assets. Incredibly, he includes in his evidence to support this claim the screenshots of his January 2023 message to Ryne Miller — despite the fact that Judge Kaplan already determined that his arguments that the message was just an attempt at being helpful "d[id] not appear, on a preliminary basis, to be a persuasive reading". Kaplan later decided that the same message was one of two instances in which Bankman-Fried had tried to tamper with a witness, and rescinded his pre-trial release.

Bankman-Fried's arguments regarding losses were rebutted by the prosecutors in several different ways and, somewhat awkwardly, also rebutted by the very same bankruptcy team he quoted to support his claims that customers would be reimbursed at 100%.

To summarize the government's objections to this line of argument:

- Any return of funds to creditors is a result of the bankruptcy team's efforts, not Bankman-Fried's.b

- The effort to return funds only commenced after the fraud was discovered.

- Creditors have not actually received any funds back, and it's not certain how much they will recover or when.

- His reference to the bankruptcy team's statement that creditors "will eventually be paid in full" omits important caveats from the bankruptcy team around uncertainties that could result in a smaller recovery, ignores the fact that they were referring to "allowed claims" rather than total losses, and ignores the fact that victims will likely suffer significant losses as a result of the dollarization of claims based on cryptocurrency prices at the date of petition, rather than prices today.

- Even if the judge agreed that there was zero loss to FTX customers due to bankruptcy recoveries, there is still the issue of the $1.7 billion in losses suffered by FTX investors. These investors are not expected to recover any of the money, and the amount of losses to them alone justifies the $550 million sentencing enhancement.

- Even if the judge agreed that actual losses were zero, sentencing guidelines are based on "the greater of actual loss or intended loss", and the facts at trial established that Bankman-Fried intended to fraudulently misappropriate billions of dollars.

The bankruptcy team themselves filed a victim impact statement repeating the government's arguments 1–4. Responding directly to Bankman-Fried's claim that the "harm to customers, lenders, and investors is zero" and that FTX was solvent at the time it filed for bankruptcy, CEO John J. Ray writes, "I can assure the Court that each of these statements is categorically, callously, and demonstrably false."

Dozens of victim impact statements describe enormous financial losses of varying types. Some needed access to the funds that were locked in their FTX accounts, and were forced to obtain loans or sell property instead. One wrote:

Thirty years of preplanned retirement income...gone

Personal home...gone

Ability to purchase retirement home...gone

Real Estate investments...gone

Passing down of significant family wealth...gone

Two personal vehicles...gone

Others described opportunity costs, where they were forced to change their financial plans in ways they believe negatively impacted their futures. Almost all of the letters lamented the likelihood that victims will not be able to enjoy the gains on their crypto assets, as the bankruptcy proceedings are likely to pay out claims in dollars based on the price of Bitcoin and other assets on the date of bankruptcy ($16,871, in Bitcoin's case) rather than their prices today (around $70,000, or over four times as much). In fact, most of the letters were solely focused on this issue, and some seemed to hope that Judge Kaplan might be able to change the payment plan (despite it being overseen by a separate judge in a separate court).

Although a later letter from Bankman-Fried boldly sneers at the government's "precious 'loss' narrative", this all seems like a very steep uphill battle for Bankman-Fried. Even just getting the judge to accept that estimated losses are below that $550 million mark, much less zero, seems a herculean task. That's what he's banking on, though, because that 30-point downward departure from the pre-sentence report's calculated offense level is what would get Bankman-Fried into the territory of a six-year-long sentence.

Sentencing

The Probation Department calculated Bankman-Fried's offense level to be 56 based on the sentencing guidelines. Those guidelines max out at a total offense level of 43, and would call for a life sentence even for those who fall into Criminal History Category I (as Bankman-Fried does, with no criminal history). However, the maximum sentence for Bankman-Fried's offense is 110 years.c

The pre-sentence report ultimately called for a 100-year sentence, calling for a downward variance of 10 years for reasons that are not immediately apparent to me.d

The government, however, has decided to request a sentence of only 40–50 years. They argue that such a long sentence is warranted in order to both prevent Bankman-Fried from reoffending, and to provide a deterrent effect for others who might be tempted to try to pull off a similar scheme.

They do not seem optimistic about Bankman-Fried's future prospects, writing that "A sentence that resulted in the release of the defendant while he is at a working age would leave open the very real possibility that he perpetrates again." For this, they point to four things:

- The multitude and scale of crimes Bankman-Fried committed demonstrate that he is not concerned by potential harm to others or the potential for consequences to himself.

- Bankman-Fried's repeated misconduct while on pretrial supervision demonstrate that even while under significant restrictions, he was still not deterred from malfeasance.

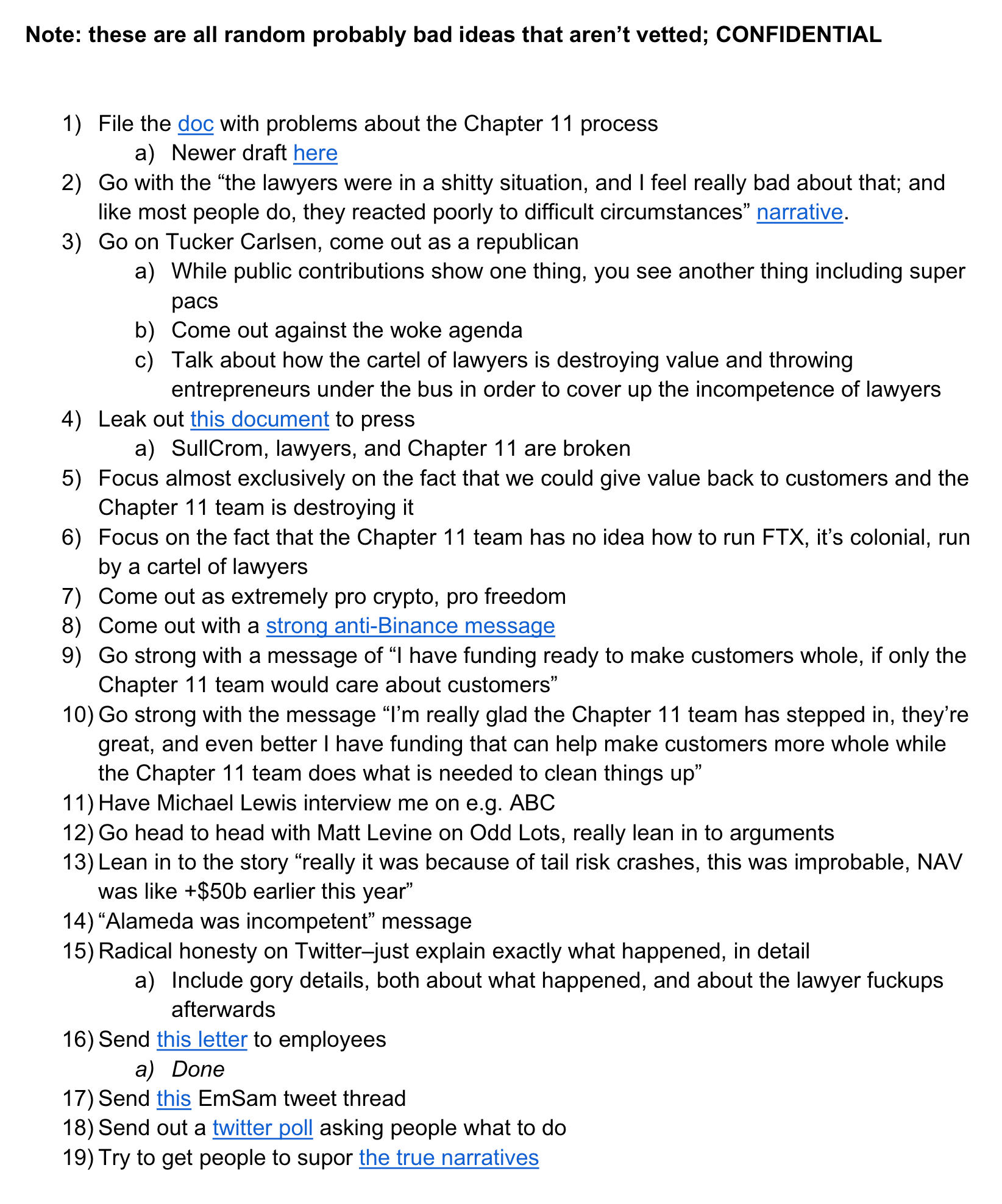

- It seems quite plausible that Bankman-Fried might try and succeed in running another fraud if given the opportunity, particularly given his ability to craft narratives around himself. They point to a Google document that Bankman-Fried prepared shortly after FTX's bankruptcy, in which he floated the idea of launching "Archangel LTD" (a new cryptocurrency exchange to supplant FTX). He also brainstormed ideas to rehabilitate his image, including "Go on Tucker Carlsen [sic], come out as a republican", seek support from "random subgroups" including the alt-right or "some other displaced group", "come out as extremely pro crypto, pro freedom", embrace the narrative that "SBF died for our sins", condemn the bankruptcy lawyers, or applaud the bankruptcy lawyers.

- Bankman-Fried's effective altruism and own statements about risk suggest he would be likely to commit another fraud if he determined it had high enough "expected value". They point to Caroline Ellison's testimony in which she said that Bankman-Fried had expressed to her that he would "be happy to flip a coin, if it came up tails and the world was destroyed, as long as if it came up heads the world would be like more than twice as good". They also point to Bankman-Fried's "own 'calculations'" described in his sentencing memo, in which he says his life now has negative expected value. "Such a calculus will inevitably lead him to trying again," they write.

On the other hand, the government does not seem to want Bankman-Fried to serve what would effectively be a life sentence, and so have instead recommended a 40–50 year sentence based on the theory that Bankman-Fried will be past working age when he gets out. Currently 32, Bankman-Fried would be released at age 72 to 82 if he served the entirety of a sentence of that length. With good behavior, federal inmates can serve 85% of their sentences1 (in this case, 34–42½ years), meaning Bankman-Fried could be released as early as age 66 on a sentence of this length.

Bankman-Fried describes the pre-sentence report's 100-year recommended sentence as "grotesque" and "barbaric". They minimally address the government's recommendation, but say that it would "break" and "crush" Bankman-Fried. Instead, they ask for a relatively short sentence that would allow Bankman-Fried to "return... to a productive role in society". They argue that Bankman-Fried would not reoffend, for reasons including that "he would sooner suffer than bring disrepute to any philanthropic movement."e They also argue at length that Bankman-Fried is already being punished by negative media coverage, loss of assets and his livelihood, and his status as a convicted felon, and that this should have bearing on his eventual sentence. They blame the negative media coverage on the prosecution. I would submit that if Bankman-Fried didn't want to receive negative media coverage during his prosecution, perhaps he should have opted not to perpetrate the multi-billion-dollar fraud that warranted such prosecution.

Bankman-Fried also takes the sentencing memo as an opportunity to condemn the criminal justice system in general, writing that sentencing guidelines for white-collar crimes are absurd and result in overlong sentences. In a later filing, he cites research demonstrating that inmate life expectancy decreases by two years for each year served. While I admire Bankman-Fried's new commitment to criminal justice reform, I do suspect it will have little impact on a senior judge in the Southern District of New York, who sentences white-collar criminals day in and day out, and has probably contemplated the sentencing guidelines at least once or twice in his thirty years on the job.

Restitution and forfeiture

Prosecutors are also seeking a $11.02 billion judgment, in addition to the assets Bankman-Fried has already forfeited to the government. Bankman-Fried describes this request as "draconian", and submits that the forfeiture amount should be zero. In a filing after the government's submission, he objects to the monetary judgment, but not to the forfeiture of already-seized assets, which he says largely belonged to the company and not to him personally.

Bankman-Fried argues that the requested forfeiture money judgment would be "ruinous to [his] ability to earn a livelihood in the future", and therefore unconstitutional. They add: "If the money judgment sought by the government is granted, it is simply inconceivable that Sam will ever be in a position to satisfy it. That appears to be the point."

Likely outcome

I'm always hesitant to predict the future, particularly in legal matters as someone with no legal background, but I will be shocked if Bankman-Fried's arguments find much traction with Judge Kaplan. With limited (and generally inconsequential) exception,f the government's arguments seemed persuasive and Bankman-Fried's did not.

Judge Kaplan has broad discretion over the eventual sentence, and although judges often stay within the bounds of sentences requested by prosecutors, he doesn't have to.

Bankman-Fried's behavior on the stand, which the government argues amounted to perjury in several instances, is also not likely to sway Kaplan in his favor. Furthermore, Kaplan is intimately familiar with the facts of the case, and it seems unlikely that he will accept Bankman-Fried's version of events — which in several cases fly in the face of evidence presented at trial.

I suspect that Bankman-Fried will be spending much of the rest of his life in prison, likely in the ballpark of the 40 to 50 year sentence requested by the prosecution.

His sentencing is scheduled for Thursday, March 28, and I'll keep you updated on the outcome.

Footnotes

Well, sort of. Bankman-Fried maintains his innocence, and plans to appeal, so he really thinks that 0 years is the appropriate sentence. However, accepting the jury's verdict, his requested modifications to his calculated offense level come out to a recommended sentence of 63–78 months. ↩

They also point out that much of the bankruptcy team's recovery was achieved in spite of Bankman-Fried's best efforts, not thanks to them. They point to Bankman-Fried's attempt to gain control of more than 55 million shares of Robinhood stock, priced at around $650 million, "in an apparent effort to prevent the bankruptcy estate from recovering those assets." Neither Bankman-Fried nor the FTX estate have succeeded in obtaining control of the shares, yet — they were seized by the Department of Justice, and the multi-party battle over their rightful owners will continue. ↩

Somehow, 110 years is defined to be less than a life sentence. Perhaps the government is optimistic on life extension research. ↩

The pre-sentencing report is not publicly available, so I am relying only on characterizations of it gleaned from both sentencing submissions. ↩

This is quite a bold claim, given the enormous disrepute Bankman-Fried has brought to the effective altruist movement. ↩

I see some merit in, for example, Bankman-Fried's arguments against the government's claims that he has failed to accept blame for the FTX collapse. It seems to me that he has, at least to the extent that he's able to while also not admitting guilt on charges he plans to appeal. This is mostly an academic exercise, though: at best, accepting responsibility would result in a 2- or 3-point decrease in his offense level, which is not material when his offense level already exceeds the maximum by more than ten points. ↩

References

"Prison Time Surges for Federal Inmates", Pew Charitable Trusts. ↩