Issue 53 – Choose rich

Euphoria has risen along with crypto prices, but nothing has changed from the last bubble.

Bitcoin prices surpassed their previous all-time-highs on March 5, and crossed the $70,000 mark on March 8. There's no real narrative to go with it this time besides "number go up", which in a way is kind of refreshing. Unlike last time, there isn't (yet?) a widespread push to convince people that in a year they will all be tracking their groceries on the blockchain or getting paid in crypto to post on social media.

On the other hand, it is a little frustrating to see crypto people suggesting that since the price went up, everything is fixed in crypto and the critics should eat their words. On the contrary, mosta of my major concerns remain just as concerning as they were when I first started writing about this, if not more so, and another bubble means more people are going to get hurt. I'm not sure if crypto folks are truly misunderstanding my criticism that badly, or if they just can't resist the urge to tell me to "have fun staying poor" even though they know it has little to do with my commentary. Probably some of both.

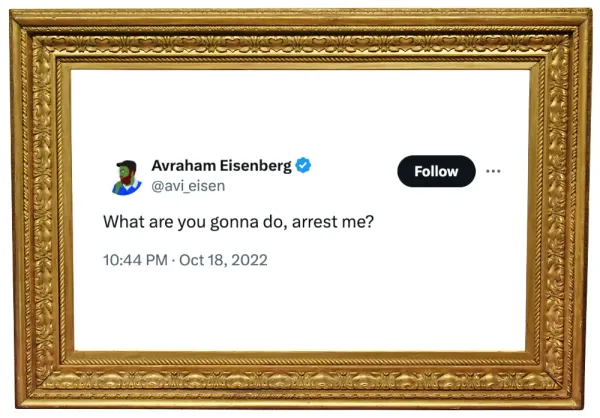

Speaking of "have fun staying poor", the new version of that catchphrase seems to be "choose rich", which was popularized by a very cringey individual named "NFT Nick" who either likes to lie about how wealthy he is or is just doing a bit, depending on who you ask. Seems like kind of an unpleasant guy (or persona) to base your new catchphrase around, but then again, HFSP and similar sentiments are unpleasant too.

Community notes on Twitter have helpfully pointed out the "$5,000 bottle of champagne" he's holding costs less than $85 (via Twitter)

In the courts

Bitcoin Fog

Roman Sterlingov, the founder of the Bitcoin Fog cryptocurrency tumbler, was convicted by a jury on four charges of money laundering and running an unlicensed money transmitting service. Though he denied it, the jury found that Sterlingov was indeed the person behind the service that allegedly processed more than $400 million in transactions, some of which were tied to various darknet marketplaces.

Sterlingov faces up to 20 years in prison on the charges, and has already spent almost three years in jail leading up to his trial. He will be sentenced in July.1

Sterlingov is not to be confused with the other cryptocurrency mixing service operators, Roman Storm and Roman Semenov, who are facing charges for their operation of Tornado Cash. Apparently there's a rule somewhere that if you operate a crypto tumbler, you have to be named Roman S.

Binance

Former Binance CEO Changpeng Zhao has been ordered to surrender his Canadian passport as a part of a set of modifications to his bond conditions that were requested by prosecutors [I52].2 The conditions now also reflect that he's not allowed to leave the United States, and must inform Pretrial Services of any planned travel within the US.

The change prohibiting him from leaving the country is mostly just an administrative move, since he was already ordered to remain in the United States a while ago after prosecutors convinced the judge he posed a flight risk. Zhao filed a limited objection to the motion to update the bond conditions, arguing that the change requiring him to notify the government of travel within the US wasn't necessary since Zhao's travel within the country "has not been an issue to date". The government responded that "something that 'has not been an issue to date' can become an issue in the future," and that there are plenty of situations in which the government might quite reasonably wish to be made aware of Zhao's whereabouts:3

In truth, it is easy to imagine scenarios in which concerns could arise about post-plea travel by a multibillionaire defendant whose permanent residence is in a nonextraditable country (UAE) and who has Canadian citizenship. For example, if Zhao wanted to travel to the Canadian border shortly before sentencing, the government could legitimately worry that he might be planning to flee.

The judge apparently agreed with prosecutors on this, and made the changes.

Craig Wright

The weird Craig Wright trial is coming to its weird end [I51, 52], with Wright accusing his critics of bugging his house and spoofing his emails in an attempt to frame him for fabricating evidence.4 COPA, the group that brought the suit, has said in their closing arguments that they intend to ask to refer documents from the case to UK prosecutors based on their belief that Wright perjured himself throughout the trial — something he has been known to do in the past.5 There are some more closing arguments to come, then Judge James Mellor will issue a ruling on whether COPA has proved beyond a reasonable doubt that Wright is not Satoshi Nakamoto, the creator of bitcoin.6

Christopher Harborne

Bitfinexb shareholder Christopher Harborne has filed a defamation lawsuit against The Wall Street Journal over their March 2023 article titled "Crypto Companies Behind Tether Used Falsified Documents and Shell Companies to Get Bank Accounts" (archive). Harborne says the article falsely accused him of fraud, money laundering, and terrorist financing. To my (non-lawyer) read, the lawsuit seems more about what readers might have inferred from some reporting about Harborne's alleged involvement with Tether than about any specific erroneous claims of fact by the Journal, though Harborne does also say that the Journal made some factual errors, too.

The Journal article was updated on February 21, 2024 — a week before the lawsuit was filed — to remove several paragraphs at the end about Harborne and a bank account he applied to open. Harborne is now not mentioned in the article at all, outside of an editor's note. From the note, the Journal also seems to be more worried about potential inferences, and doesn't issue any factual corrections:

Editor’s Note: A previous version of this article included a section regarding Christopher Harborne and AML Global, which applied for an account at Signature Bank. The section has been removed to avoid any potential implication that AML’s attempt to open an account there was part of an effort by Tether, Bitfinex or related companies to mislead banks, or that Harborne or AML withheld or falsified information during the application process. (Feb. 21, 2024)

Harborne claims in his lawsuit that he demanded the retraction in December 2023, months after the article was published. I wonder what took him so long, both to initially demand the retraction and then to file the lawsuit.

Whatever it was, Harborne seems to be suddenly very aggressive in getting the allegations taken down, along with any possible reference to them elsewhere. Several other journalists and outlets who published stories based on or mentioning the Journal's reporting removed the mentions (Matt Levine at Bloomberg), or deleted the stories completely (New Money Review, Protos, Unchained). Harborne also demanded Dirty Bubble Media remove some portions of a Substack post where he referenced some of the now-retracted claims from the WSJ's reporting, and in turn demanded that David S. H. Rosenthal remove references to Dirty Bubble Media's post he'd made in a blog post of his own.

The lawsuit was filed in Delaware, which seems like a bit of a strange choice given Harborne has no apparent ties to the state (that I could find), and both the Wall Street Journal and its parent company Dow Jones are headquartered in New York. Harborne claims in the lawsuit that he chose Delaware because that's where Dow Jones is incorporated... as so many companies are. I'm sure it's that, and it has nothing to do with the fact that New York has a very strong anti-SLAPP law, and Delaware's is quite weak.7

He's represented by Clare Locke, a notorious defamation litigation firm that brags about "killing stories" in the media,8 and has become a go-to choice for rich people who don't like what journalists have published about them.c Elizabeth Locke, one of the named partners at the firm, once stated in a speech to the Federalist Society that "the pendulum has swung too far in the direction of freedom of the press" — the kind of thing that should immediately provoke a moment of "are we the baddies?" self-reflection in any reasonable person.9

Anyway, I'm deeply interested in how this one goes, and hope to be able to read the Journal's response soon.

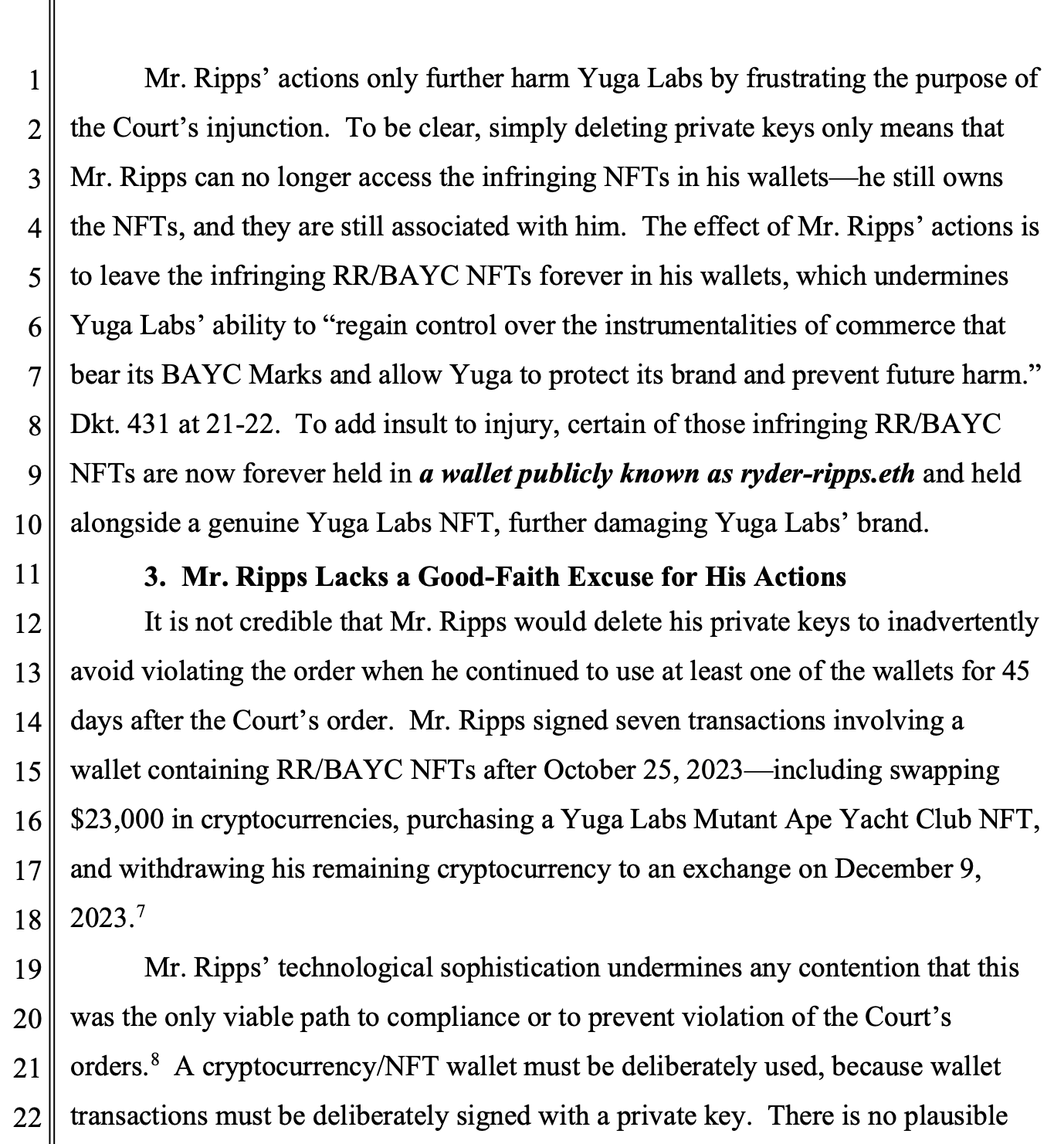

Yuga Labs v. Ryder Ripps

The drama truly never ends in this case, although I feel like I'm the only one following it at this point [I13, 14, 25, 43, 44, 45]. As Ripps and his co-defendant Jeremy Cahen work on their appeal of the trademark infringement decision that will — if upheld — require them to pay out $9 million in damages and attorney's fees, Yuga Labs has filed a request that the judge sanction them over two issues.

First, Ripps has apparently informed them that he destroyed the private keys to a cryptocurrency wallet containing some of the RR/BAYC NFTs that were at issue in the case. Yuga says this was an intentional, bad-faith act by Ripps to stymie an injunction he knew was coming. Ripps claims he did it to ensure he didn't somehow accidentally violate an earlier court injunction. Yuga isn't buying that at all:

Secondly, Yuga notes that Ripps and Cahen haven't paid the $120,000 they were supposed to pay within two weeks of the final judgment. Ripps and Cahen say they can't pay it. But Yuga cast some doubt that, noting that Cahen transferred $30,000 from a crypto wallet to an exchange and bought a $11,200 NFT after the court order.d

Those pesky public blockchains...

Everything else

The Australian Securities and Investments Commission appears to have woken up after failing to investigate the massive ACX/Blockchain Global collapse in 2021 [I46]. The founders of that firm went on to create the HyperVerse crypto pyramid scheme, which stole more than $1 billion from mostly Australian victims [I46, 48, 50]. Now, ASIC says they've secured an interim restraining order to prevent one of the firm's directors from leaving the country. "It is not apparent why the investigation was commenced when it was, given when Blockchain Global failed," said Justice Catherine Button when approving the judgement.10 Get em.

In bankruptcies

The US SEC argued that Terraform Labs — the company behind the collapsed Terra/Luna blockchain projects — is siphoning funds that belong to creditors to its legal team. According to the agency, Terraform Labs has sent $166 million to the Dentons law firm, and "the transfers appear designed to remove assets from the estate that could be used to pay a judgment arising from the SEC Enforcement Action." They urged the court to reject Terraform Labs' retention of the Dentons law firm unless they return roughly half of the $166 million retainer, and has requested the court appoint a fee examiner.11

The bankruptcy court wasn't convinced, allowing Terraform to hire the firm and agreeing that the legal expenditures were necessary and appropriate, though Dentons has agreed to send $48 million of the advance fees back to Terraform for now.12

In governments and regulators

DAOs can now achieve legal standing in crypto-friendly Wyoming. This prompted an excited post from Andreessen Horowitz general counsel Miles Jennings, who wrote about how the law will allow DAOs to do things like pay taxes — something they've always been really keen to do.13

Although the US SEC is no stranger to pushback from the cryptocurrency industry, thanks to their much more aggressive enforcement strategy in the past few years, pushback is also increasing from other parts of government. A vote in the House Financial Service Committee advanced a resolution that would appeal the SEC's Staff Accounting Bill 121, which was enacted in April 2022, and which requires crypto asset custodians to report the assets they custody as liabilities on their own balance sheets. The resolution passed thanks to votes from all Committee Republicans and three Democrats, who argued that the rule was improperly issued without consultation with various banking regulators — although no public notice or comment period is required for SABs. Votes opposing the attempt to appeal came from the likes of Maxine Waters (D-CA), who described the SAB as a necessary consumer protection to try to safeguard against custody mismanagement such as what happened at FTX.14

Also coming out swinging at the SEC are a group of eight state attorneys general who requested to file an amicus brief in the ongoing SEC case against the Kraken cryptocurrency exchange. They argue that the SEC is trying to define all crypto assets as securities, which they say could conflict with state consumer protection laws to do with crypto.15 Those AGs are behind only one of many amicus briefs submitted in that case, with others coming from various blockchain lobbying groups and laser-eyed Senator Cynthia Lummis (R-WY).16

That emergency survey about crypto miner energy use [I50, 52] is officially kaput after strong opposition from the cryptocurrency industry, although the EIA still seems interested in a survey that would happen through non-emergency means.17 While I think the cryptocurrency industry's reaction to it was a little extreme, I did share their confusion over why it was such an emergency. I do think a non-emergency survey is a good idea, simply to try to get a better grasp on just how much electricity these miners are burning through.

Katie Porter (D-CA) lost her Senate race, finishing with under 15% of the vote. She appeared to point a finger — at least in part — to the crypto lobbying efforts against her [I51, 52] when she made a rather hotheaded comment about "billionaires spending millions to rig this election". This immediately drew quite reasonable condemnation from those who viewed the comment as a Trumpian suggestion of election fraud, though she later issued a statement that she did not mean the voting process itself had been "rigged".18 Altogether, the superPAC spent $10 million campaigning against Porter. Now they're apparently focused on Ohio, Montana, Maryland, and Michigan in upcoming Senate races. Ohio's Sherrod Brown (D) suggesting banning crypto altogether after the FTX collapse, and Montana's John Tester (D) said around that same time that he "see[s] no reason why this stuff should exist". Candidates in Michigan and Maryland have not been particularly outspoken about crypto.19

A bill has passed in the United Kingdom that will likely result in more crypto asset seizures, because law enforcement will no longer have to wait for a conviction before seizing crypto assets.20

Spain wants Sam Altman to take his ball orb and go home. The AEPD data protection agency has ordered his Worldcoin project to stop scanning eyeballs in the country, and stop using data gathered from their citizens. In particular, they're concerned that the company is not complying with laws requiring firms to properly inform users about how data collected from them will be used, and to provide them with the right to erase it. "I want to send a message to young people. I understand that it can be very tempting to get €70 or €80 that sorts you out for the weekend," said director España Martí, but she urged that "giving away personal data in exchange for these derisory amounts of money is a short, medium and long-term risk."21

Elsewhere in crypto

Pig butchering

A finance professor at the University of Texas at Austin has released a report suggesting that romance scammers have stolen more than $75 billion in cryptocurrency since January 2020 in what have come to be known as "pig butchering" scams.

It's no surprise that there are massive, organized operations involved, such as the compound in Myanmar described by the Financial Times in late February. That particular operation had reportedly scammed more than $100 million in only two years, using thousands of workers who themselves were victims of human trafficking. (Good news: shortly after the report was published, 1,200 of these victims were freed in a raid.22)

But the $75 billion number was certainly a surprise, and it's hit mainstream outlets including Time. I have to say I have some doubts about the number, particularly given other estimates have been in the low billions, but regardless, it's clear that the pig butchering issue in crypto is a multi-billion dollar problem.

Otherside underdelivers

Yuga Labs did a third playtest for their Otherside massively multiplayer online game, which they first announced in March 2022. They've since raised more than $300 million just from selling NFTs representing Otherside "land deeds",e but have shockingly little to show for an actual game besides two — now three — brief demos.

In late February, shortly before the third scheduled demo, Eric Reid (the game's leader at Yuga) published a blog post about how "it's been a challenging six months" for the project. He seemed to try to walk back some of the many massive promises that Yuga has made about the game since its inception, which have included that people would be able to play as all kinds of NFT avatars (even from projects outside of Yuga's ownership) and "move between metaverses", that it will allow thousands of people to voice chat at once, and that it will feature "rich immersive gameplay supported by AI and physics"f. Previous demos had shown off MMORPG-style boss-fights between hundreds of Apes and supersized boss creatures.

In the blog post, though, Reid was much more cautious. "It's not a polished, launchable public product", he warned. "The 'near term' in building something like Otherside is measured in years, not weeks or months. Everyone has to accept that objective reality." He continued to try to temper expectations: "I think it’s important to take a beat and also clarify what we are not doing for now on Otherside. We are not making a competitive MMO that takes many years, many tens of millions of dollars, and has enormous risks." But fear not, because they will let other people do that for them for free. After expounding on how independent developers could work on the platform, he said, "This means you could eventually get a game built."23

Tell me you overpromised without telling me.

There had been a bunch of excitement among holders over the "Apes Come Home" event, where owners of Bored Ape NFTs (that still somehow sell for more than $50,000 a pop) would be able to walk around as their apes and explore their "exclusive digital clubhouse". After all of that tempering of expectations, I knew the playtest was going to be a doozy.

As it turned out, immediately upon joining the game, players were each attacked by a "goat" who "steals their voice", which I'm sure was a carefully-crafted part of the storyline and not just a convenient explanation for why that multi-thousand-person voice chat they'd promised — or even a basic text chat — isn't working. Everyone was then equipped with a "Koda Cam" with which they could take selfies and photos of various landmarks to earn achievements, which might have been a little more groundbreaking had it been released 25 years ago, before Pokémon Snap came out on the Nintendo 64. The environment is basic, with graphics resembling what most MMOs achieved a decade or more ago, and characters' interaction with it is minimal — grass remains untouched when they run through it, and the Apes appear to walk on glasslike water with nary a ripple rather than swim through.

While those who had paid tens or even hundreds of thousands of dollars for a Bored Ape NFT could play as their character and join the clubhouse, those commoners who only spent thousands on their NFTs were left relegated to the public zones, and all of them rendered as the same generic robot figure. As for the clubhouse, the whole thing looked... sticky... and mostly featured other apes standing around, taking selfies, or trying out the "twerk" animation, since there was nothing else to do.

Players were limited to 60 minutes in the demo, spread over three sessions to try to limit load on servers they once promised would support "10,000+ players". Despite that, one NFT enthusiast who'd spent $75,000 on a Bored Ape, and was generally very excited about the whole concept, admitted that the game felt "slow" and that the "only problem I really had was that I felt bored."242526

The Bored Ape floor price took a nosedive after the playtest, plummeting from around 22 ETH ($87,000) to around 13.5 ETH (~$53,500). I guess I'm not the only one who found it to be a pretty sad state of affairs after hundreds of millions of dollars and two years of work.

The Web3 is Going Just Great recap

There were 8 entries between February 29 and March 12, averaging 0.6 entries per day. $77.51 million was added to the grift counter.

Kickstarter's weird plans to pivot to blockchain make a lot more sense now

[link]

Fortune Crypto (archive) just made Kickstarter's inexplicable insistence on pivoting to blockchain in late 2021 and 2022 a lot more explicable by uncovering that it was an attempt to raise $100 million from the likes of Andreessen Horowitz. Chris Dixon was, naturally, a big part of it: "For Dixon, the prospect of shepherding a familiar name like Kickstarter into the promised land of Web3 proved too enticing to pass up."

The problem was, Kickstarter's community hated the idea, probably in no small part because they couldn't get a clear answer from Kickstarter on why the company would benefit from a blockchain at all. When quizzed about the choice in a March 2022 interview, Kickstarter COO Sean Leow seemed to believe that blockchains were some sort of competing idea with "open source". Tom McKay wrote for Gizmodo in December 2021, "How this will actually work, beyond Kickstarter being able to yell 'blockchain' like a spell to summon investors ... , is unclear." Got it in one.

Kickstarter seems to have largely abandoned the blockchain idea by now, probably out of fear of complete user revolt or because they realized that blockchains were not going to be helpful to their service. Fortunately for them, the deal wasn't contingent on Kickstarter actually doing the pivot.

We're all trying to find the guy who did this

[link]

The crypto investment firm, Crypto4Winners, that promised 377% returns, and that was co-owned by a fraudster who was convicted in 2017 for running investment schemes that conned victims out of $1.5 million, has just halted withdrawals after claiming that someone at the company seems to have "committ[ed] fraudulent acts that may have compromised the integrity of assets". Gee whiz.

Even though a relatively prominent crypto media outlet ran a report in January about the fraudster's involvement, many of the firm's customers were resistant to the information, and calls for more transparency in a Reddit community devoted to the firm were routinely met with accusations of "FUD" (fear, uncertainty, and doubt).

"Many people I’ve interacted with who invest in the fund seem to be indifferent to how returns are made, as long as they’re made," said one crypto investor and investigator who looked into the project before its closure.

Everything else

- Incognito Market drug marketplace pulls multi-million dollar double scam [link]

- Twitter phishers steal over $46 million from 57,000 victims in February [link]

- Unizen platform hacked for $2.1 million [link]

- WOOFi hacked for $8.75 million [link]

- "The AI Protocol" burns tokens after holder suffers $4.3 million theft [link]

- Shido exploited for at least $3.3 million [link]

Worth a read

Matt Binder and Ed Zitron had a great chat recently about the rising bitcoin prices, and what that's likely to mean in the near future. They also had a fun chat about the Apple Vision Pro (whatever happened to those, anyway?), AI, and tech hype. Matt and Ed are a really fun combo, and every time Ed goes on that show he ends up flying into a rage that's pretty fun to watch. (This is a compliment.)

A journalist is being prosecuted for cybercrimes after accessing Fox News videos that were more or less publicly available, if not necessarily intentionally so. "The digital age will yield more Tim Burkes—people who have the skill to track down newsworthy information in the dustiest corners of the internet, and the opportunity to share it in order to better inform the public. The more reason they have to fear FBI agents knocking on their door, the likelier they are to stop, sigh, and close the browser window instead."

In the news

I spoke to Steven Ehrlichg at Forbes about the recent bitcoin price movement. I really tried to drive home the fact that nothing has changed since the last crypto bubble. I also spoke to a reporter at Investopedia for an article titled "Bitcoin Surged to a Record High Tuesday—What's Behind the Rally, Can it be Sustained?", where I also tried to make those same points.

The folks over at Germany's Heise Online tech news publication asked to translate and republish my review of Chris Dixon's Read Write Own, which I happily agreed to. I doubt there are many people who read this newsletter and couldn't already read the English version, but I'm including the link here nonetheless.

That's all for now, folks. Until next time,

– Molly White

Footnotes

I can only think of one concern of mine that has been even remotely addressed: the reduction of the once massive environmental impact from the Ethereum blockchain, thanks to The Merge towards the end of 2022. Credit where credit's due for that one, but the environmental concerns have not generally been the biggest focus of mine. ↩

Bitfinex is a cryptocurrency exchange and sibling entity to the Tether stablecoin issuer. Although the two firms used to claim to be separate entities, they largely abandoned that charade after the 2017 Paradise Papers revealed their shared ownership. ↩

Recently, they were retained by billionaire-turned-plagiarism-detective Bill Ackman to write a very expensive and very nonsense retraction demand letter to Business Insider, after BI reported on his wife's own plagiarism and made Ackman so mad that he made sure thousands of people who'd never even heard of her now knew she had plagiarized.27 ↩

Technically the 2.89 ETH Cahen paid for the NFT were worth $9,930 on the day he bought it, but I'm not sure quibbling over that will help him much. ↩

Not to mention the billions in sales from Yuga's other NFT collections, at least one of which you have to own if you want to play the game. ↩

This newsletter is also supported by physics! $300 million, please. ↩

Forbes' Steven Ehrlich is not to be confused with Stephen Ehrlich, the former CEO of the collapsed Voyager crypto platform. I wonder how often that gets mixed up, for a reporter on the crypto beat. ↩

References

"Crypto 'Mixer' Convicted of Money Laundering on Bitcoin Fog", Bloomberg. ↩

Order modifying bond filed on March 11, 2024. Document #71 in US v. Zhao. ↩

Reply by USA as to Changpeng Zhao filed on March 1, 2024. Document #68 in US v. Zhao. ↩

"Craig Wright Accuses Critics of Bugging His House, Spoofing Emails to Bring Him Back to Court", CoinDesk ↩

"Judge finds Craig Wright committed perjury, must surrender half of his Bitcoin billions", Decrypt. ↩

"Craig Wright ‘Committed Perjury’ in U.K. Trial Over Satoshi Claims, COPA Says", CoinDesk. ↩

"State Anti-SLAPP Laws", Public Participation Project. ↩

"If You're A Journalist Hiring Lawyers To Intimidate Publishers Into Killing Stories About Your Misdeeds, You're A Hypocrite", Techdirt. ↩

"New York Times, NBC, and '60 Minutes' Bigwigs Hired These Media Assassins to Fight #MeToo Stories", The Daily Beast. ↩

"Former crypto director banned from leaving Australia after Blockchain Global collapsed owing $58m", The Guardian. ↩

Objection of the U.S. Securities and Exchange Commission filed on February 27, 2024. Document #86 in In re: Terraform Labs. ↩

"Bankrupt Terraform gets OK to hire law firm Dentons, with return of $48 mln from retainer", Reuters. ↩

"Wyoming governor signs into law a bill to give DAOs legal standing in the state", The Block. ↩

"House Committee passes resolution to block SAB 121", Blockworks. ↩

Proposed amicus brief filed on February 29, 2024. Document #51-1 in SEC v. Payward, Inc. ↩

"SEC Overstepped Bounds in Kraken Lawsuit, State AGs Charge", CoinDesk. ↩

"Emergency bitcoin miner survey off the table after parties agree to end lawsuit", The Block. ↩

"Katie Porter’s star dims in failed US Senate bid, leaving the Californian facing an uncertain future", AP News. ↩

"Coinbase-Backed $85 Million Crypto Super PAC Sets Its Sights on Senate Races", Decrypt. ↩

"UK Bill for Seizing Illicit Crypto Finally Becomes Law", CoinDesk. ↩

"Spain tells Sam Altman, Worldcoin to shut down its eyeball-scanning orbs", Ars Technica. ↩

"1,200 slaves freed from Myanmar pig-butchering compound", Protos. ↩

"Otherside Blog Feb 21 2024", Yuga Labs News. ↩

"You’ll Need To Spend $70k To Enter This Digital Bathroom And Twerk", Kotaku. ↩

"Otherside's 'Apes Come Home' Third Trip was CRAZY! Bored Ape Yacht Club's Metaverse Gameplay", George NFTs on YouTube. ↩

"Orangie Plays the 'Otherside' Apes Come Home Game Event With His Bored Ape", Decrypt. ↩

"No One Cares That Bill Ackman’s Wife May Have Plagiarized; They Care About Ackman’s Hypocritical Double Standard", Techdirt. ↩