Issue 49 – And so the Lord says "give them a 10x"

Bitcoin ETP approval, God-sent crypto scammers, and more trouble in Justin Sun's world.

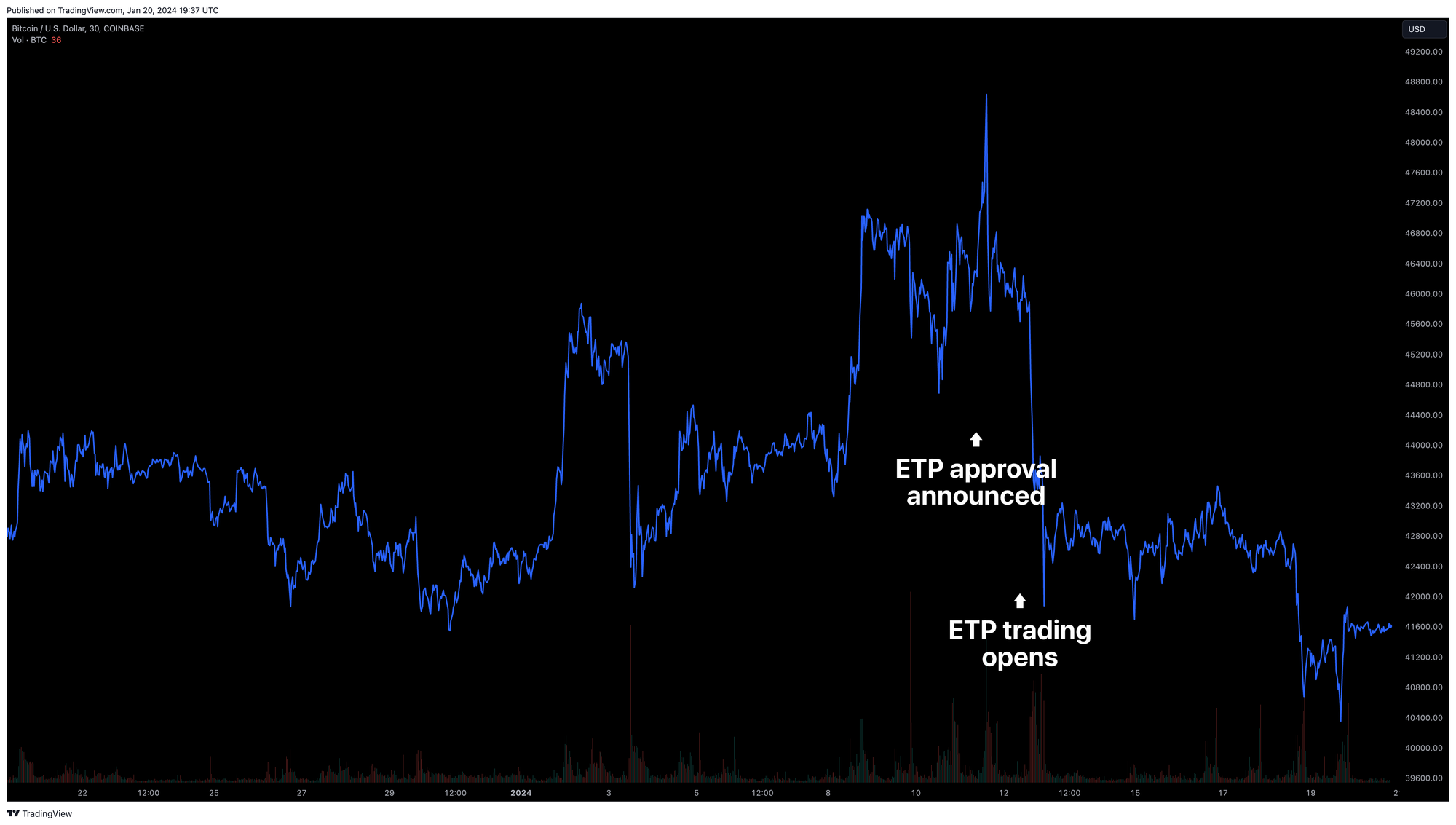

The SEC approved those eleven applications to create the first-ever bitcoin spot ETPsa that I mentioned last week [I48]. Although most people knew it was coming, this was still big news in the crypto industry, which has been awaiting such a product for more than ten years.

The approval came with it a statement from SEC Chairman Gary Gensler, and I've honestly got to hand it to him as a writer. I've heard people speak through gritted teeth before, but I'm not sure I've ever read anything so clearly written through gritted teeth until now. With all the sincerity of an apology that starts with "my mom said I have to apologize," Gensler announced the approval (which he voted for), explaining that the SEC was left with little choice but to approve the applications after an appellate court overturned a previous rejection decision [I38]. He ended his statement with a firm condemnation of bitcoin:1

Though we’re merit neutral, I’d note that the underlying assets in the metals ETPs have consumer and industrial uses, while in contrast bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware, money laundering, sanction evasion, and terrorist financing. While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.

Three other SEC Commissioners also issued statements: the historically crypto-loving Hester Peirce celebrated the approval and condemned her own agency for taking so long to get around to it.2 Similarly, Mark Uyeda spoke positively about the approval while criticizing the SEC's process.3

Caroline Crenshaw, who voted against the approval, issued a strongly critical statement, writing that the agency's "actions are unsound and ahistorical. And worse, they put us on a wayward path that could further sacrifice investor protection."4 You would not imagine my surprise when I noticed she'd cited my work in her dissenting statement! (Footnote 16). Jaime Lizárraga also dissented, but did not issue a statement of his own.

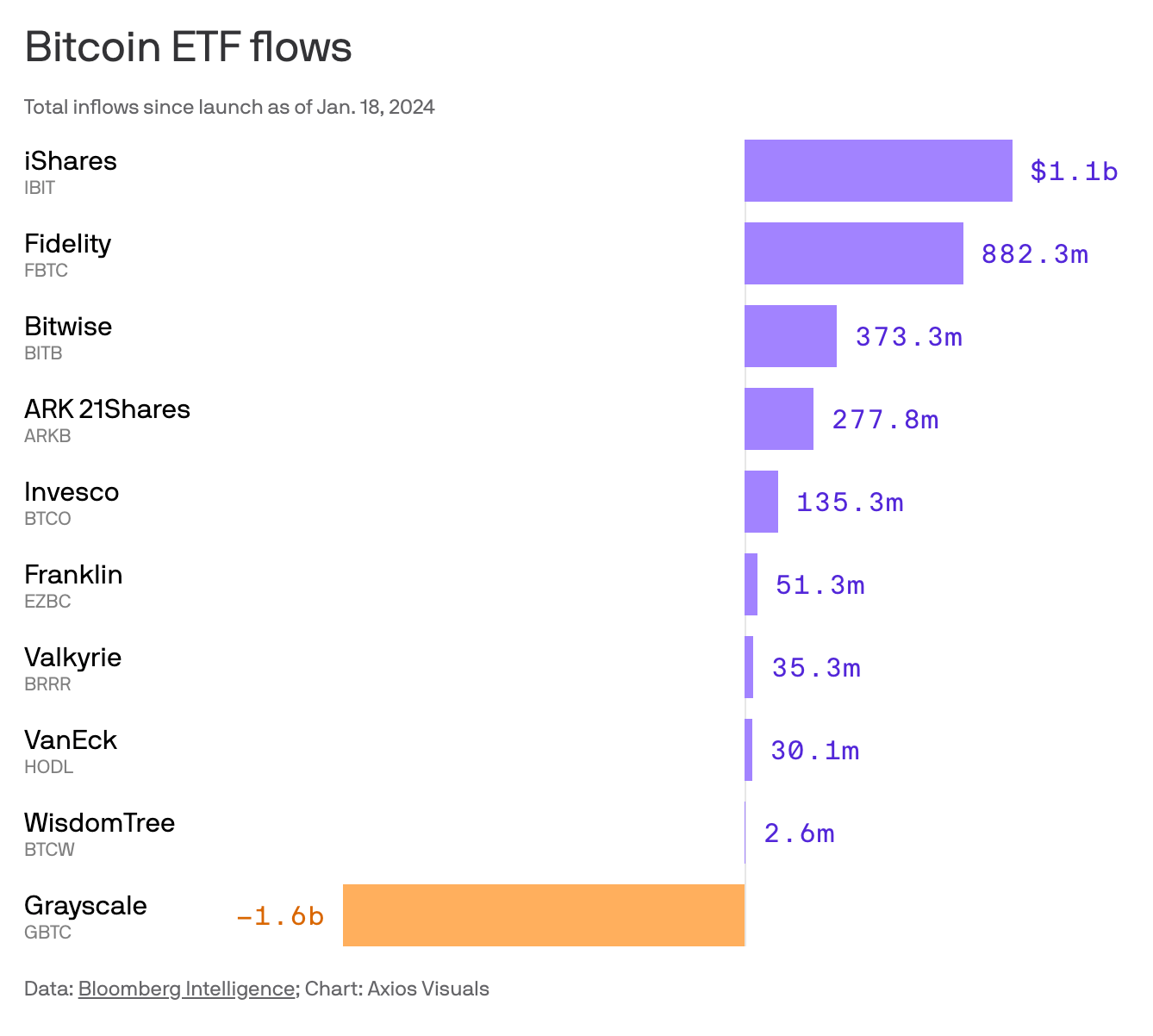

Trading opened on Thursday, January 11, and there was indeed substantial early interest — although some of the reported billions in trading consisted of investors pulling funds out of the long-standing Grayscale Bitcoin Trust, or GBTC (which was converted from a trust into an ETP as a part of these approvals).

Previously, GBTC holders had no option to redeem the bitcoins held in the fund. Now that they do, people are cashing out. Some are taking profits on a trade that was basically a bet on the GBTC conversion being approved: buy the GBTC shares prior to approval, when they were still trading at a discount to BTC, then redeem and sell the BTC post-approval (or just sell the GBTC shares, which are no longer trading at a discount). Others seem to be leaving GBTC in order to reinvest their funds into the new, competing ETPs that offer lower fees. Bitcoin futures ETPs also saw outflows.

The industry seems pretty split on whether the Bitcoin ETPs were the runaway success many had predicted. Those who confidently predicted massive price surges on the funds' approval have either been disappointed or — more commonly — come up with reasons why the bitcoin price hasn't surged yet, but soon will. Much like doomsday predictors, those who confidently predict bitcoin prices are rarely stymied when their prediction dates pass by unfulfilled.

Bitcoin price movement has looked pretty... normal since the ETP approval. It's down somewhat, but that's not unusual for an asset class that constantly fluctuates. As far as price is concerned, the reaction to the ETP news was a resounding "meh".

Many insist that it's far too early to evaluate the ETPs' success or failure (I agree), and that massive institutional and layperson adoption is just around the corner (not so sure on that one).

A portion of my writing from the last issue was quoted in a CoinDesk piece about industry reactions to the ETPs, and I just had to highlight one other quote in there. It was as if I was reading my own writing, except that this appears to be completely genuine rather than dripping with sarcasm as it would have been out of my own mouth:

Now the process will be straightforward to buy Bitcoin for retirement accounts with much lower fees. Today is the last day ever where the only people incentivized to shill $BTC and crypto are us in the community. Tomorrow, all these ETF issuers will have teams of people incentivized to call our parents/grandparents up to talk about Bitcoin. Anil Lulla, CEO of Delphi Digital

God help us all (and especially our grandparents).

In the courts

SBF's retained some new lawyers to his team as he prepares for his sentencing hearing: Marc Mukasey and Torrey Young, both from a law firm called — you guessed it — Mukasey Young.5 Mukasey is a former federal prosecutor who previously worked on white-collar cases including the defense of Trevor Milton, the fraudster sentenced in December to four years in prison for lying about non-existent technical achievements by his Nikola electric car company.6 Mukasey has also participated in some high-profile political litigation, and was once described as "the lawyer at the center of the Trump universe" (before apparently stepping back from that role).7 As for crypto, Mukasey and Young are also defending Alex Mashinsky in his criminal fraud case pertaining to the Celsius collapse, which is scheduled for September.6 Busy busy! At this stage they don't seem to be replacing SBF's previous lawyers, just adding to them. I still think he's almost certainly going to appeal his conviction, so maybe they're working on that.

Speaking of Mashinsky, he's moved to have two counts dismissed in his criminal fraud case. He wants charge two (commodities fraud) dismissed as "repugnant to and inconsistent with" charge one (securities fraud),b and charge six (security price manipulation) dismissed because Mashinsky... didn't know it was a crime. More precisely, the filing says that Mashinsky knew that market manipulation could be a civil violation, but that "the government decided to invent a criminal offense out of what was, according to the only available precedent, a civil regulatory violation."8

Do Kwon asked for his trial in the case filed by the SEC to be postponed from late January until late March, in hopes that Montenegro will have decided where to extradite him by then, and that he might thus be able to participate in the trial. The SEC agreed this was a reasonable request. The judge decided to grant it, but noted he would not grant further extensions even if Kwon is still in limbo by then. Kwon's day in court is now scheduled for March 25.9

Former OpenSea head of product Nathaniel Chastain is appealing his May 2023 conviction [W3IGG]. He's arguing that the insider information that Chastain was trading upon was not "property" of any particular value to OpenSea, and thus can't be the object of a wire fraud charge.10 Worth a shot, I guess.

Leaving the topic of criminal courts, there was a hearing on Coinbase's motion to dismiss the SEC v. Coinbase lawsuit this week. Among other things, Coinbase's lawyers argued their "crypto is not like stocks, it's like Beanie Babies, your honor" argument they'd first made in the written filing back in August.

pretty remarkable to see Coinbase making the argument that crypto is not like stocks, it's like baseball cards, American Girl dolls, or Beanie Babies

— Molly White (@molly0xFFF) August 6, 2023

it's the future of finance! except when the SEC comes knocking, then it's just a harmless little toy, your honor pic.twitter.com/j8jTBxKQGj

(Tweet)

Perhaps this is a useful argument to make when trying to argue that your company isn't selling unregistered securities, but it does seem somewhat unhelpful as far as Coinbase's marketing strategy, which relies on convincing buyers that crypto is the "future of finance" and not just a speculative bubble akin to the Beanie Babies craze.

Still, Judge Katherine Polk Failla did seem sympathetic to some of Coinbase's arguments. "I want to understand how your standard does not sweep in the collectible market or commodities. It is a real fear that I have that your argument is just sweeping too broadly," she said to SEC lawyers. On the other hand, she also showed some skepticism towards Coinbase's arguments that the SEC is violating the "major questions" doctrine by enacting highly significant regulations without Congressional instruction. "I’m just not sure the crypto industry is so major and so extraordinary," that the doctrine would apply, she said.11 Failla didn't make any decision on dismissal during the five-hour-long hearing.

Class action litigants are having the same kind of trouble serving soccer star Cristiano Ronaldo in their lawsuit over his Binance promotion [I45] as did the class action litigants in serving Shaquille O'Neal in the lawsuit relating to his FTX promotion. Shaq was finally located and served at his home in Atlanta;12 litigants are trying to get the courts to allow them to serve Ronaldo (who owns at least six homes but doesn't seem to live in any of them) through less traditional means, like via tweet.13

In bankruptcies

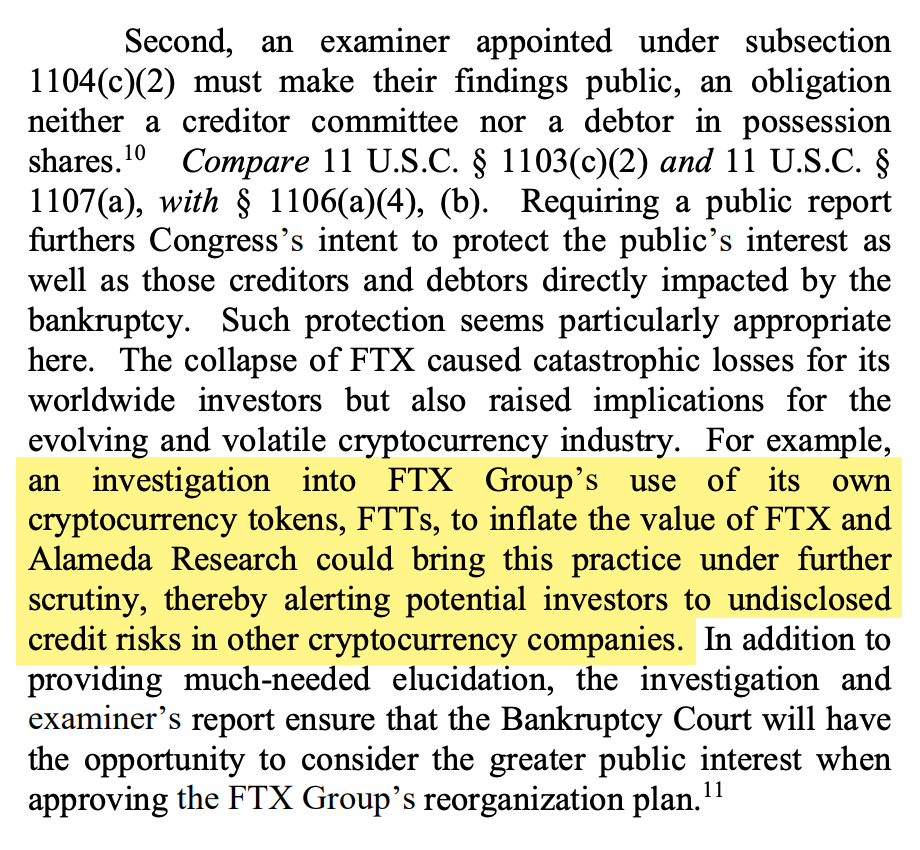

An independent examiner will be appointed in the FTX case, after the Third Circuit overturned Judge Dorsey's decision not to appoint one.14 Dorsey was mostly concerned at the potential cost of an investigation that could be duplicative with FTX's own efforts, and which he estimated would be north of $100 million [I18, I20]. Although creditors had broadly agreed with this decision, not wanting to see their payouts dwindle even further than they already have thanks to the already exorbitant costs of the bankruptcy case, the US Trustee has been pushing hard for it, arguing that the bankruptcy judge was required to appoint an independent examiner because of a clause in the US Bankruptcy Code seeming to mandate one in cases where debts exceed $5 million. When the appeal was first filed, the Trustee was joined by a group of law professors who filed a spicy amicus brief raising concerns about the debtors' ability to investigate themselves, and about possible malfeasance by Sullivan & Cromwell, a prominent law firm that has provided services to FTX before and after its collapse [I43].

The Third Circuit has agreed with the Trustee's interpretation of the statute. They've also pointed out that an examiner could be useful to shed light on common cryptocurrency industry practices, and they called out specifically the practice of companies using tokens they create to boost their own valuations.

I was delighted to see this callout, because they're practically repeating the calls for scrutiny I made in an op-ed for the New York Times trying to call attention to this very practice:

What prosecutors never focused on in the [FTX] trial is the practice that had helped generate that enormous loss, which is similar to the practice that propped up FTX and Alameda... pumping up the price of a token with no real value behind it and using that inflated valuation to lay the foundation of a business’s balance sheet or to borrow dollars. ... I believe that same practice is still propping up vast swaths of the cryptocurrency industry today. Not only are crypto firms operating with massive undisclosed credit risk, they’ve also often managed to sidestep the kind of outside scrutiny that might have been invited by more traditional funding models. And when a business funded in this way collapses — or, as in FTX’s case, explodes because of fraud — it is the people who’ve given up their money for a whole bunch of nothing who suffer.

While I do understand the concerns over the cost of an additional investigator, I am glad to see an independent examiner being installed, and am very much looking forward to their report. For a taste of what these reports look like, you might enjoy my writing on the one that came out of the Celsius bankruptcy last year.

Meanwhile, the bankruptcy court is also being inundated with objections to a motion FTX filed that would allow them to estimate the values of digital assets involved in the case based on their dollar prices at the time of the bankruptcy filing.15 Although I don't think approval of this motion would actually explicitly grant FTX the right to eventually repay creditors in dollars rather than in-kind, it does seem like a step in that direction, and that has creditors very worried.

Although it's pretty standard for asset prices to be estimated in dollars based on the prices at the petition date, this has been enormously unpopular among creditors in crypto bankruptcy cases who generally want their crypto back, not those filthy dollars. It really doesn't help that crypto prices have generally rebounded since November 2022, meaning people are looking at getting about $16,800 back per Bitcoin instead of today's $41,700. Had prices gone in the other direction, I suspect there might be fewer objections — although perhaps the FTX bankruptcy team would also be more amenable to in-kind repayments in that case.

Many of the objections are identical to one of two form letters that must be going around for people to print and sign. And most are letters (form or otherwise) from individual creditors without any lawyer involvement, meaning there are some somewhat entertaining gems in there (such as the person warning the judge that their language may be inexact and unlawyerly, "since I am a normal person"). Other bigger and be-lawyered groups, including Avalanche, Auros, LayerZero, and the liquidators for Three Arrows Capital, have also registered objections.

If you're in the market for luxury property in the Bahamas (as I'm sure many readers of this newsletter are), a few more options might hit the market pretty soon. FTX has filed a motion to be allowed to sell various properties, including the penthouse-turned-nerd commune known as "The Orchid".

Also on the list are various other condos in the Albany resort complex, some office suites, and a property in the gated community of Old Fort Bay: the same community where Bankman-Fried's parents signed the documents for a beachfront home.16

Speaking of Sam Bankman-Fried's parents, Joe Bankman and Barbara Fried have asked the court to dismiss the adversary lawsuit against them from FTX, which claims that the millions of dollars their son's company sent to them were fraudulently transferred and, in Bankman's case, were a breach of fiduciary duty.17 They're arguing that Bankman had no such fiduciary duty, and that both lacked the requisite intent with respect to the fraudulent transfer claim.

Over in the Celsius bankruptcy, people who were either savvy enough or lucky enough to withdraw their funds before the company halted withdrawals are now discovering their luck may have run out. Those who withdrew more than $100,000 in the three-month period leading up to the bankruptcy may see a portion of their money clawed back. They would then join the group of creditors hoping for some — but likely not all — of that money back.18

In governments and regulators

The United Nations called out Tether — and particularly Tethers issued on the TRON blockchain — as a major player in money laundering and other criminal activity in Southeast Asia. "USDT on the TRON blockchain has become a preferred choice for regional cyberfraud operations and money launderers alike due to its stability and the ease, anonymity, and low fees of its Transactions," they wrote in a report. They cited an audit by Bitrace, which found around $17 billion in Tether transactions connected to illicit activity between September 2022 and September 2023.19 Tether is, of course, "disappointed" in being "single[d] out" in the report, and whipped out the old "you just don't understand the technology!" argument.20

CBDCs — central bank digital currencies — are becoming a topic on the campaign trail in the United States. Although they'd been condemned by some of the various unlikely hopefuls for the Republican nomination in the past, Donald Trump himself brought them up at a campaign rally in New Hampshire, pledging that he would "never allow" such an example of "government tyranny"21 — something that, by the way, has not actually been seriously proposed in the US.

However, it's unlikely that his audience actually knows altogether that much about CBDCs and what they would entail. Instead, the idea has become more of a broad metaphor for government overreach — particularly given that China is among the countries to have introduced one. I suspect we'll keep hearing about CBDCs in the lead-up to the presidential election, though I doubt the discussion will be much of actual substance, and instead will remain shorthand for Big Government trying to take away your financial self-sovereignty.

To be clear, I'm not huge fan of CBDCs as they've generally been described either, but I do prefer my conversations to actually involve the topic at hand, rather than using that topic as a vague metaphorical allusion to a shadowy Big Bad.

Over in the regulatory world, there's a now an investigation into the Twitter account compromise that enabled the fake tweet from the SEC's Twitter account that prematurely announced the approval of the bitcoin spot ETPs. The FBI is now helping out, too. Evidently the SEC never bothered to turn on two-factor authentication, allowing an attacker to SIM swap the account.22

Elsewhere in crypto

The cold snap in Texas seems to have had a noticeable impact on the Bitcoin hashrate. Due to miner curtailment — the practice in which crypto mining firms are paid to stop mining during periods of high electricity demand that often accompanies temperature extremes — the Bitcoin hashrate dipped around 34%.23

The British actor who played the role of the fake HyperVerse CEO has apologized for his part in the scam, saying that he was assured by his agent that "Many people do this in the business. This is perfectly normal." His agent might not be far off — deception in the crypto industry is pretty normal. He was paid $5,000 and got a free suit for his troubles.24

The Web3 is Going Just Great recap

There were 12 entries between January 10 and January 20, averaging 1.1 entries per day. $21.3 million was added to the grift counter.

Your Honor, God told me to start a crypto scam

[link]

A pastor for an online ministry in Colorado, Eli Regalado, and his wife were just charged by the state's securities division for allegedly taking more than $1.3 million of the money he raised from the Christians he targeted for his INDXcoin crypto scam. He's not the first person to try to combine prosperity gospel and cryptocurrency, but he sure is among the most forthright about it.

He released a video to the followers of his INDXcoin project to try to explain what had happened, saying: "So the charges are that Kaitlyn and I pocketed $1.3 million, and I just want to come out and say that those uh charges are true." He then explained that around $500,000 went to the IRSc and another "few hundred thousand went to a home remodel that the Lord told us to do."

And on the eighth day, the Lord said "let there be granite countertops".

The whole video is nine minutes long, but I made a quick supercut of some of the highlights.

The charges are civil, so Regalado isn't (yet) facing any jail time. Perhaps he should add avoiding criminal charges to the list of miracles he needs to be praying for.

His scam victims, meanwhile, seem to mostly believe his claims that he was just doing what God told him to do. Either that, or God also told him to make some fake replies to his video.

TrueUSD depegs

[link]

Avid readers of this newsletter and of Web3 is Going Just Great will already know that the various projects Justin Sun pretends not to be closely connected to have had a tough few months.

First, his Poloniex exchange was hacked for $120 million on November 10 [W3IGG]. Then, not even two weeks later, his HTX exchange and its related Heco Chain were hacked for $115 million [W3IGG]. Meanwhile, Sun's been acting weird(er than normal) [I45].

Concerns about Sun-affiliated projects didn't help matters when TrueUSD's supposed "real-time reserves attestations" were paused because the systems behind them began reporting that liabilities exceeded assets. TrueUSD quickly came out with a statement that this was just a system malfunction, then deployed a new system to try to assuage concerns, but concerns didn't seem to be assuaged.

All of these factors, combined with some mining activity on Binance Launchpool that reportedly created some arbitrage opportunities, have contributed to TrueUSD losing its intended dollar peg. Prices slipped below $0.995 on January 15, and have largely remained below $0.99 since then — at times dropping as low as $0.973. For stablecoins, even a 1¢ dip is bad news, and larger deviations, especially for days-long periods, is pretty devastating.

Everything else

- CFTC files complaint against Debiex platform for using "romance scam tactics" to steal $2.3 million [link]

- Luis Rubiales' NFT launch condemns "radicalism and feminist extremism" and describes alleged assault as "a small mistake" [link]

- $2.7 million disappears from funds meant to compensate Hector Network investors [link]

- Socket service and its Bungee bridge suffer $3.3 million theft [link]

- Gamestop is shutting down its NFT marketplace [link]

- Harmony blockchain encounters "infinite mint" bug; accusations of wrongdoing fly [link]

- Genesis to settle with New York for $8 million [link]

- Euler Finance cofounder loses private key and, with it, $3.8 million [link]

- Trader loses $5.7 million to slippage in memecoin trade [link]

- So long, hexagon: Twitter removes NFT profile picture support [link]

Worth a read

After unsuccessfully trying to convince their customers that NFTs were the future of gaming [W3IGG collection], Ubisoft is now trying to convince everyone that actually owning the games you buy is so passé. A lot of people are up in arms about this, but Nathan Grayson over at Aftermath has pointed out the fact of the matter: with subscription services and company-run game servers and intermediary platforms like Steam, the days of buying a game in the way we once went to GameStop and purchased a physical cartridge are already largely past.

In the news

Christopher Mims wrote about three massive technology fads that seem to have passed into the "trough of disillusionment" phase of the Gartner hype cycle. Among them is blockchain, and I gave him my thoughts.

I joined the SEC Enforcement Division's Associate Director Carolyn Welshhans as a guest on Our Curious Amalgam, a podcast put out by the American Bar Association. It was a fun conversation about crypto, money, and regulation.

That's all for now, folks. Until next time,

– Molly White

Footnotes

-

Despite being broadly referred to as "Bitcoin ETFs" (including by me), these are apparently actually exchange-traded products (ETPs), not exchange-traded funds (ETFs).4 ETFs are a type of ETP, but not all ETPs are ETFs (all squares are rectangles, but not all rectangles are squares). ↩

-

I learned this week that describing an allegation as "repugnant" isn't just a lawyer being overdramatic. ↩

-

"My scam church didn't claim to be tax exempt" is only one of Regalado's many unbelievable statements. ↩

References

-

"Statement on the Approval of Spot Bitcoin Exchange-Traded Products" by Gary Gensler. U.S. Securities and Exchange Commission. ↩

-

"Out, Damned Spot! Out, I Say!: Statement on Omnibus Approval Order for List and Trade Bitcoin-Based Commodity-Based Trust Shares and Trust Units", Hester Peirce. U.S. Securities and Exchange Commission. ↩

-

"Statement Regarding the Commission’s Approval of Proposed Rule Changes to List and Trade Shares of Spot Bitcoin Exchange-Traded Products" by Mark Uyeda. U.S. Securities and Exchange Commission. ↩

-

"Statement Dissenting from Approval of Proposed Rule Changes to List and Trade Spot Bitcoin Exchange-Traded Products" by Caroline Crenshaw. U.S. Securities and Exchange Commission. ↩

-

"Mukasey Firm Gets New Name Partner Young as Frenchman Leaves (1)", Bloomberg Law. ↩

-

"Trumpworld’s Star Lawyers Exit as Storm Clouds Gather", The Daily Beast. ↩

-

Memorandum in support of motion filed on January 12, 2024. Document #42 in US v. Mashinsky. ↩

-

Order filed on January 16, 2024. Document #166 in SEC v. Terraform Labs. ↩

-

"Former OpenSea Exec Argues NFT Insider Trading Conviction Violated Law", Decrypt. ↩

-

"Judge Questions SEC’s Claim to Regulate Coinbase", The Wall Street Journal. ↩

-

"Shaquille O'Neal served in FTX lawsuit, lawyers say", CBS News. ↩

-

Status report filed on January 16, 2024. Document #13 in Sizemore v. Ronaldo. ↩

-

Precedential opinion filed on January 19, 2024. Document #66 in In re: FTX Trading Ltd, 3d Cir. ↩

-

Objection filed on January 18, 2024. Document #5953 in In re: FTX Trading Ltd, US Bankr. D. Del. ↩

-

Notice of revised proposed order filed on January 9, 2024. Document #5507 in In re: FTX Trading Ltd, US Bankr. D. Del. ↩

-

Memorandum of law filed on January 15, 2024. Document #20 in Alameda Research LLC v. Bankman. ↩

-

Notice to account holders filed on January 9, 2024. Document #4207 in In re: Celsius Network. ↩

-

"Casinos, Money Laundering, Underground Banking, and Transnational Organized Crime in East and Southeast Asia: A Hidden and Accelerating Threat", United Nations Office on Drugs and Crime. ↩

-

"Tether Challenges UN Report and Calls for Blockchain Education", Tether. ↩

-

"Trump vows to block creation of digital dollar", The Hill. ↩

-

"US FBI, SEC join probe of fake social media post from regulator", Reuters. ↩

-

"Bitcoin hash rate drops by 34% amid freezing temperatures in Texas", Cointelegraph. ↩

-

"‘I do feel bad about this’: Englishman who posed as HyperVerse CEO says sorry to investors who lost millions", The Guardian. ↩